Les offres spéciales sont une celebration exclusive de réaliser des économies tout en accédant à des produits ou providers à des prix réduits. Que vous soyez un acheteur en ligne ou que vous préfileériez les magasins physiques, ces offres sont partout, et il est essentiel de savoir remark en tirer parti. Dans cet post, nous explorerons ce

Sra Survivor Independence: Reclaiming Existence Just after Trauma

Consider a daily life controlled by unseen forces, a life where by own agency is systematically eroded. For survivors of ritual abuse (SRA), this nightmare can be a truth. [Sra Survivor Freedom] represents the prolonged and arduous journey towards regaining Command, healing from deep wounds, and creating a life free of charge through the shadows of

Find out the Best Jamaican Meals Around Me at Yeah Gentleman Jamaican Cafe

Should you’re craving genuine Jamaican cuisine made with contemporary, vibrant elements, then look no even further than Yeah Man Jamaican Cafe in Mableton, Ga. No matter if you're a regional or just viewing, this concealed gem provides a flavor of Jamaica that transports you for the island with every Chunk. At Yeah Person, we get pleasure in serv

IPTV Réinventé : L’Expérience Sans Interruption de MYONLINE-IPTV

Dans un monde où le divertissement en streaming est devenu omniprésent, MYONLINE-IPTV se distingue en offrant une expérience sans interruption, pinkéfinissant ainsi la manière dont nous regardons la télévision. Avec une technologie de pointe et une approche centrée sur l'utilisateur, MYONLINE-IPTV vous promet une expérience de visionnage i

Capturing Timeless Times: The Artwork of Wedding Videos

During the ever-evolving globe of wedding setting up, a single element has remained continuously cherished: the wedding video clip. Marriage Films have remodeled from simple property recordings to stylish, cinematic ordeals that maintain the magic on the working day For a long time to come. Below’s a more in-depth look at why investing in a spec

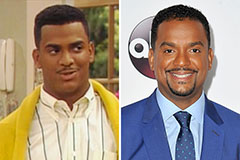

Alfonso Ribeiro Then & Now!

Alfonso Ribeiro Then & Now! Charlie Korsmo Then & Now!

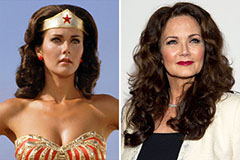

Charlie Korsmo Then & Now! Lynda Carter Then & Now!

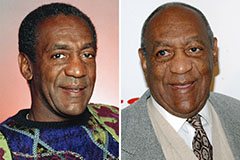

Lynda Carter Then & Now! Bill Cosby Then & Now!

Bill Cosby Then & Now! Kerri Strug Then & Now!

Kerri Strug Then & Now!